Managing finances can be difficult for anyone. This is especially so for low-income families who are struggling to make ends meet, as they tend to have limited resources and may face constant pressure to prioritize expenses. All these can create a lot of stress.

But whether you are struggling to cover essential expenses, or are saving for emergencies and the future, we have some good news. In the following sections, we will share with you a few smart budgeting tips. For you meet certain criteria that qualifies you as a low income individual or family, we also have information about what kinds of incredible government and state benefits you are eligible for. Keep on reading so you can take back control of your finances today!

Finding Your Own Ways To Save Money on a Low Income

When it comes to budgeting tips for low-income families, it often involves changing your behavior so that you can achieve the following end goals: spend money wisely, extend your resources, and build a foundation for a better future.

Another thing to bear in mind is that everyone’s situation is unique, and there is no one-size-fits-all approach to budgeting. But if you adopt some or all of these tips, you can create a customized plan that suits your family’s needs and priorities.

1. Lower your Housing Costs

The first item we focus on is housing, as it is typically the largest expense for most people. As many of you probably have the habit of setting aside a certain amount for rent each month, it’s often easy to forget there are ways to lower that cost. One reason may be because moving to a smaller or less expensive apartment can be a real hassle, especially with kids. But if you are able to find another home that’s just a few hundred dollars cheaper, it can help build up your finances quickly.

Another tip that will certainly help is to cut down on utilities expenses. For example, you can work on conserving electricity with energy-efficient appliances or simply by making sure to turn lights off when you can and unplug accessories around the house. If you’re careful about your water, electricity, and gas usage, you should expect a significantly lower utility bill each month.

Already Budgeting On Housing Costs?

So what if you think you are already paying as little as possible for housing? The truth is that with the way the cost of living in the US has been rising, it’s hard for anyone earning a regular income to keep up. So if you feel that the increase in your rent seems to be taking away a larger and larger chunk of your pay check each passing month, it may be time to explore some government programs that could be available to you. These programs may help cover a large portion of your rent and the most popular one is the Section 8 Housing Choice Program.

The Section 8 Housing Choice Program

Section 8 Housing is probably the best known program among those who are struggling with housing costs. It is overseen and funded by the U.S. Department of Housing and Urban Development (HUD) and administered by your local Public Housing Authority (PHA).

The program offers vouchers to low-income individuals to help them counter the increasing cost of living. With Section 8 Housing, participants are free to choose the home they live in as long as it meets the program’s requirements.

How Much Does Section 8 Housing Pay Every Month?

While there isn’t a set amount on how much you get when enrolling in Section 8 Housing, if you qualify for the program, generally you will be expected to pay about 30% of your current income for rent while the PHA will take care of the rest.

Here’s an example. If you make $1,000 per month and your rent is $700, that wouldn’t leave you with a lot of money left over. So your PHA calculates 30% of your income ($300), and that is all you have to pay, leaving them to pay the additional $400 rent. The PHA you work with will also make the payments directly to your landlord, so you won’t even have to worry about managing the money.

How Do I Apply For Section 8 Housing Vouchers?

So after reading about the benefits of Section 8 Housing, you must be wondering if you are eligible for the program? And just like most government assistance programs, your qualification depends on your income level.

Income eligibility criteria vary between local PHAs. But typically, you must make less than 50% of the median income in your county or metropolitan area. If you make 30% or less of the median income, however, you have a much higher chance of getting accepted. Because every PHA must accept at least 75% of applicants who earn less than 30% of the median income in their area or county.

To apply for Section 8 Housing Vouchers, refer to your local PHA or a nearby HUD Office.

2. Reduce Food Expenses

Other than housing, the next major item on most families’ monthly expense list is most likely food. And if you are living on a tight budget, chances are you might already be doing some of the basics to lower your food expense, including limiting dining-out, making good use of grocery shop coupons, and looking out for items on sale. As such, here we will focus on other methods that can help you save money on food.

Plan and Cook Your Meals

A common misconception is that buying boxed, packaged, and pre-prepared food is cheaper. In fact, the opposite is true, and that you can eat for very cheap by making your own meals, especially if you know how to cook by seasons. Typically, fruits and vegetables that are currently in season are much cheaper at grocery stores, so it’s good to plan your meals based on that.

You can buy non-perishable foods in bulk such as canned goods, rice, pastas, etc., for relatively cheap prices also, you can find recipes online that are specifically catered to those on a food budget. Budget Bytes is a great website for this.

Don’t Buy Drinks

Drinks, such as juice, soda, and alcohol, are all unnecessary expenses that don’t offer much nutritional value. Even though an occasional cold beer to go with your dinner or a glass of juice for your kid isn’t the end of the world, it’s best to avoid spending on drinks regularly. For the sake of your long-term health and your wallet, try limiting your daily beverage choice to mostly just water.

If you want to take it a step further, you can even budget money on water. If you typically buy bottled water, you can consider investing in a water filter that allows you to purify your tap water to make it safe to drink. Some great filters you can try are Brita’s Everyday Pitcher, Hydros Slim Pitcher, and Culligan Faucet Mount that connects right to your faucet.

How Can I Get FREE Food?

If you’re already using all the above food budgeting tricks to save money yet you still think they are too expensive, don’t worry. Just like for housing, there are plenty of government assistance programs aimed at helping you save on food expenses. In fact, there are a few programs that do a great job of both helping you save and making healthy and nutritious food available for you. Here are a few of the more well-known ones.

Supplemental Nutrition Assistance Program (SNAP)

Supplemental Nutrition Assistance Program (SNAP) has been around for decades. It’s a federally funded program that provides food assistance to those in need.

SNAP works by giving you an Electronic Benefits Transfer (EBT) card. The program will then deposit money into the card each month for you to spend on food. The EBT card can be used at local farmers markets, grocery stores, convenience stores, pharmacies, etc.

How Do I Apply For SNAP?

To start getting SNAP food assistance, you must apply with local or state SNAP office of your residency and meet some resource and income requirements. Note that these criteria are updated annually. For households with elderly or disabled members, there are special SNAP rules that can be found here.

For your local or state SNAP office, you can locate the nearest one to you with this directory.

3. Get a Starter Emergency Fund

Every household should have an emergency fund of some sort. This is even more important if you have a family. An emergency fund is essentially a portion of your income that you set aside each month. They are meant for you to use in future in case of sudden medical bills, car repairs, or other unexpected expenses.

Another tip that tends to get overlooked by many people is that when setting up your emergency fund, try to use a savings account with a high interest rate and easy access. That way your money will continue to grow by itself, but you can still access it in case of emergencies.

4. Lower Your Car Payment

Car payments, just like housing and food, are another significant expense many of us have to deal with. In the US, most cities and areas require you to have some sort of vehicle to get around. For example if you have to commute to work or if you need to drive your kids to school. But is there a way where you can pay off your car in a smarter way?

If you are driving a car, one obvious solution is to simply check whether there’s another one that’s easier for you to afford. Give a call to your local car dealers and see if you can trade in for something more affordable. As long as the car is in good condition and gets you from point A to point B, you can save a lot of money with a cheaper car.

Already have an affordable car? Try getting an extended loan term. An extended term on your loan will mean paying less each month. That may mean a higher interest rate in the long-term, but if you work hard to better your financial situation, it may be worth paying the extra money once you have more.

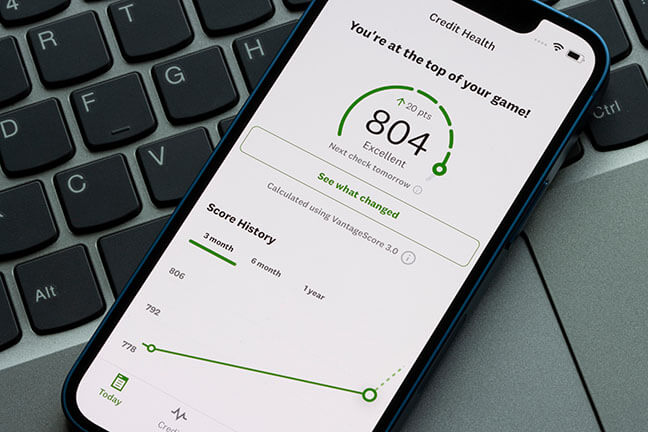

5. Work On Your Credit Score

If you’re already practicing good budgeting tips and are spending money more efficiently, an additional thing you can do to save money is to focus on improving your credit score. As we mentioned with the car payments, getting better terms on your loans, such as lower interest rates or extended loan terms, can help you greatly especially when you are on a low-income budget.

Having a higher credit score can also present many opportunities to actually increase your income. Whether by investing in real estate, starting a business, or even getting some student loans to pursue a higher-paying career.

How Do I Increase My Credit Score With a Low Income?

There are many ways to achieve a higher credit score. One of them is by getting a new credit card, though you should also remind yourself to not change your spending habits once you have it. Just remember this rule: you shouldn’t buy something with your card if you don’t have enough money yourself to pay for it.

There are many credit cards you can get to help build credit. It’s worth looking around for a good bank or credit union for this. As long as you continue to follow a strict budget with your new card, you should be able to use it as a tool to eventually make more money and achieve financial stability.

Bonus Budgeting Tip: Don’t buy a phone. Get a FREE one with EASY Wireless!

Another expense category that often gets overlooked is connectivity. This can include things like Wi-Fi, phone bills, and mobile devices, etc. Although some may consider these expenses non-essential, many of us would probably agree they’re becoming more and more necessary for things such as finding jobs or doing school work.

Whether to stay in touch with family and friends, certain essential resources, and co-workers or employers, connectivity plays a key role in our lives. But despite it being highly accessible, they can be very expensive. Luckily, there are also programs designed specifically to help you stay connected:

Lifeline/ACP Programs with EASY Wireless.

Lifeline and the Affordable Connectivity Program (ACP) are government programs designed to make phone and internet services more affordable for eligible low-income individuals and families. At EASY Wireless, we understand the importance of affordable connectivity for everyone, and we want to help you access the benefits of these programs so that you can stay connected while lowering your financial burdens.

Using Other Assistance programs for Lifeline and ACP with EASY Wireless

Upon enrolling in one of these programs, you can receive EASY Wireless benefits that includes the following:

EASY Wireless Unlimited Plan

- FREE Unlimited Data

- FREE Unlimited Talk

- FREE Unlimited Text

- FREE Brand-new Smartphone

- FREE SIM Card Kit and Activation

- Choose to Keep Your Number or Get a New One

How do I Apply For EASY Wireless Benefits?

When you come to one of EASY Wireless’s retail stores, our customer service agent will help you apply for the benefits.

The first step is to provide proof of identity with a government-issued ID. This is so you can confirm your participation in one of the qualifying programs or that you meet the household income requirement.

We accept the following U.S. Government Issued ID:

- U.S. Driver License

- Certificate of U.S. Citizenship

- Certificate of Naturalization

- U.S. Passport

- U.S. Government, State or Tribal issued-ID

- U.S. Military ID cards

- Permanent Resident Cards

- Permanent Resident Alien Cards

You can show the following documents to prove that you are taking part in a government assistance program or use them as proof of active benefits:

- Statement of benefits from a qualifying Program.

- Notice letter of participation, such as an award letter

- Program participation documents, such as a screenshot from an online account.

- In order to show income, you can provide any of the following proofs:

- Unemployment Documentation

- Copy of your State or Federal income tax return.

- Three months’ worth of current pay stubs.

- Veterans Administration or SSI benefits letter.

- A divorce decree or child support document that states income.

- Retirement or pension statement.

Need More Than Just One Line of Service or an Additional Phone?

EASY Wireless is a full-service cellular store that cares about all of your communication needs. We have a wide range of pre-paid plans for every budget and usage requirement. Also, we offer a selection of brand-name phones that combine quality, reliability, and the latest technology.

That’s not all – we also provide an array of amazing accessories to enhance your mobile experience. At EASY Wireless, we’re dedicated to providing exceptional service and ensuring you find the perfect plan, phone, and accessories to suit your lifestyle and preferences.

Visit us for all your cell phone and wireless service needs today!

Start Saving Today!